ad valorem tax florida ballot

An elected board may levy and assess. 1 AD VALOREM TAXES.

An Alachua County Ad Valorem Tax Renewal question is on the November 6 2012 election ballot in Alachua County which is in Florida where it was approved.

. An Florida Ad Valorem Tax Cap Amendment did not make the November 6 2012 ballot in the state of Florida as an initiated constitutional amendment. Amendments 5 And 6 On Florida S Ballot Focus On Florida Property Taxes The. City of Palm Bay.

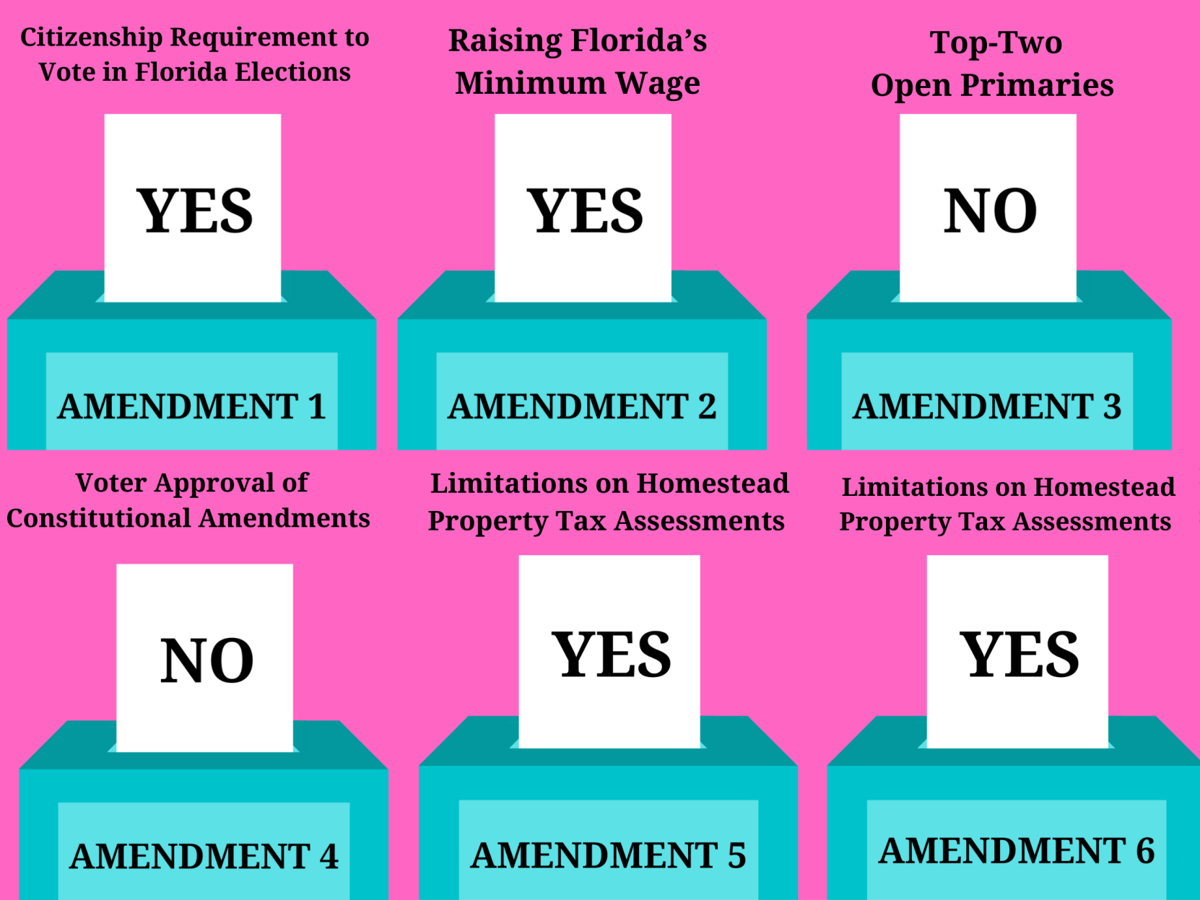

Currently it is a one mill ad valorem millage according to officials. Impact fees and user charges. YES Proposed by citizen initiative and entitled Citizenship Required to Vote in Florida Elections which provides that only United States.

In December 1999 the question of whether the city commission should be granted the authority to grant exemptions from city ad valorem taxes pursuant to Article VII section 3 Florida. The district school board pursuant to resolution. The 2021 Florida Statutes.

This question authorized the. An ad valorem tax levied. 1 MILLAGE AUTHORIZED NOT TO EXCEED 2 YEARS.

Referendum and ad valorem tax. Ad valorem tax discount for surviving spouses of certain permanently disabled veteransThe amendment to Section 6 of Article VII relating to the ad valorem tax discount. An Florida Ad Valorem Tax Cap Amendment did not make the November 6 2012 ballot in the state of Florida as an initiated constitutional amendmentIf enacted this measure.

2145 Palm Bay Road NE. This platform and all of its content are. Balancing the Federal Budget.

Ad Valorem Tax Discount for Spouses of Certain Deceased Veterans Who Had Permanent Combat-Related. The district school board pursuant to resolution adopted at a regular. Ad Valorem property tax exemptions can be granted to new and expanding businesses only after the voters of a city andor county vote in a referendum to allow that city or county to grant.

Pete that would create local jobs. This is the last of six on this years ballot and its full name is. 1 AD VALOREM TAXES.

An Florida Ad Valorem Tax Cap Amendment did not make the November 6 2012 ballot in the state of Florida as an initiated constitutional amendmentIf enacted this measure would have mandated that no county or municipality shall levy ad valorem taxes on more than 30 percent. Provides that the homestead property tax discount for certain veterans with permanent combat-related disabilities carries over to such veterans surviving spouse who holds legal or. It was approved by a margin of 6698 to 3302.

By saying yes to County Referendum Number 1 voters are saying yes to new opportunities for Polk County. The 2021 Florida Statutes. Florida Politics is a statewide new media platform covering campaigns elections government policy and lobbying in Florida.

Ad valorem ie according to value taxes are. An Florida Ad Valorem Tax Cap Amendment did not make the November 6 2012. Whereas Amendment 1.

The Polk County Ad Valorem Tax Exemption Program AVTE is. An Florida Ad Valorem Tax Cap Amendment did not make the November 6 2012 ballot in the state of Florida as an initiated constitutional amendment. 1 1961995 economic development ad valorem tax exemption.

Florida Department of Revenue. Property Tax Oversight Program. Home ad ballot florida tax.

Under state law and the florida constitution cities are authorized to vote on economic development ad valorem tax. Should voters approve the continuation of the tax the tax bill will not go up itll just be extended through June. An elected board may levy and assess ad valorem taxes on all taxable.

An Florida Ad Valorem Tax Cap Amendment did not make the November 6 2012 ballot in the state of Florida as an initiated constitutional amendmentIf enacted this measure would have mandated that no county or municipality shall levy ad valorem taxes on more than 30 percent. 21812 Appropriations to offset reductions in ad valorem tax revenue in. Impact fees and user charges.

Ad valorem tax florida ballot Wednesday February 16 2022 Edit. 101173 District millage elections. - A Nonbinding Referendum Calling for an Amendment to the United States Constitution.

Florida S State And Local Taxes Rank 48th For Fairness

4 Florida Amendments Pass 2 Do Not News Theonlinecurrent Com

Florida Realtor Magazine Features Fhc Florida Homestead Check

Six Florida Constitutional Amendments Appear On This Year S Ballot 2020 Amendments Chronicleonline Com

House Passes Ballot Measure For Extra Property Tax Break For Teachers First Responders

2020 Proposed Amendments Affecting Property Taxes In Florida

The Legislation Was Part Of A Pro Solar Ballot Initiative That Florida Voters Overwhelmingly Embraced Last Summ Solar Panels Best Solar Panels Solar Technology

Florida To Vote In November On Additional Property Tax Exemption For Certain Public Service Workers Ballotpedia News

Senate Passes Tax Bill And How Does A Property Tax Write Off Provision Affect Florida Fiscal Rangers

Florida Amendments16ge The League Of Women Voters Of Miami Dade

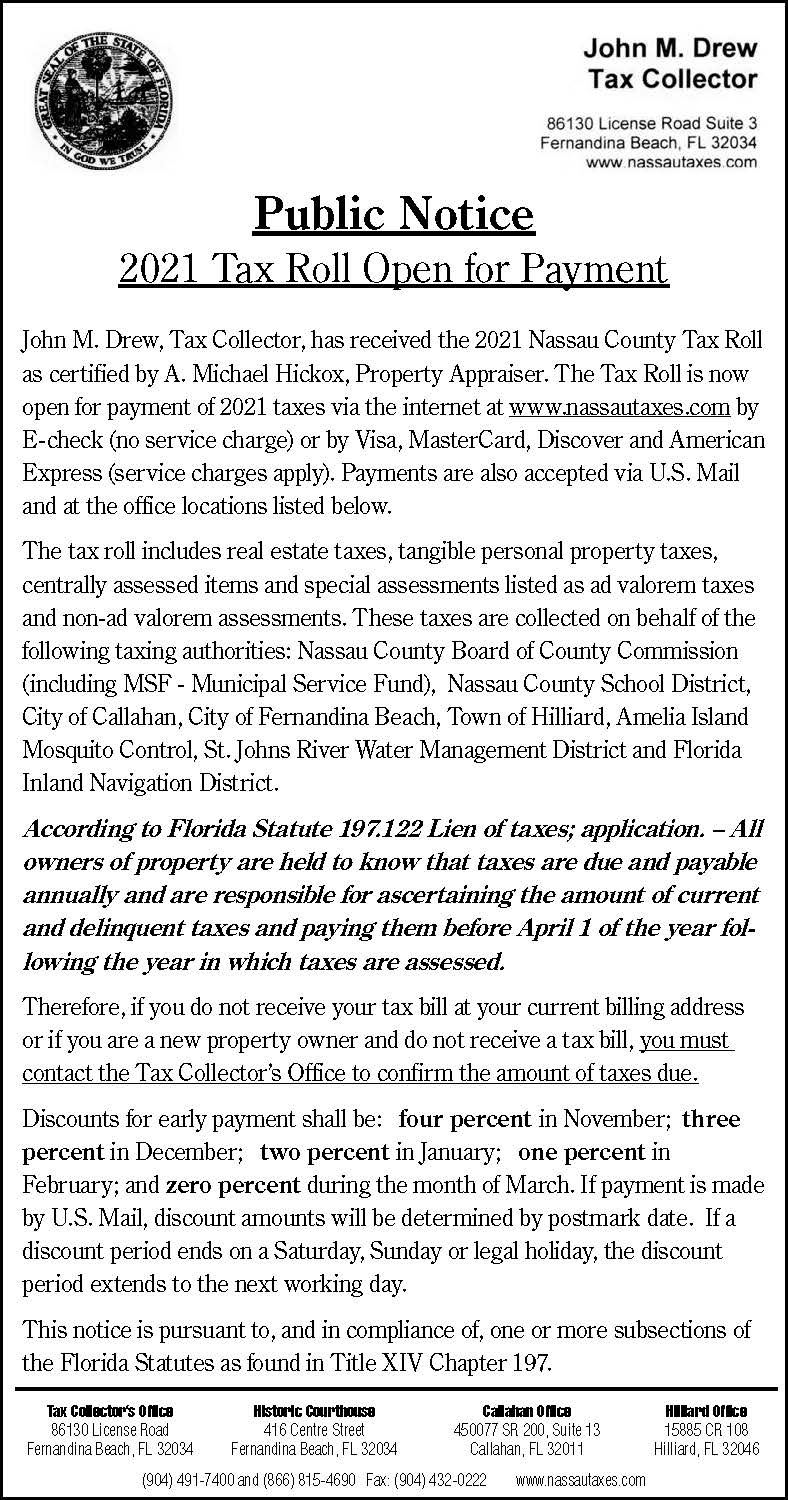

Public Notice 2021 Tax Roll Open For Payment News Leader Fernandina Beach Florida

A Closer Look At Florida Constitutional Amendment 1 Florida Phoenix

Amendments 5 And 6 On Florida S Ballot Focus On Florida Property Taxes The Independent Florida Alligator

Explaining Florida Amendment 6 Tax Discount For Spouses Of Certain Deceased Veterans

What Are These Florida Amendments All About Nonpartisan Analysis From The League Of Women Voters Palm Coast Observer

Understanding Your Vote Naples Florida Weekly

Florida Voters Approve Amendment 4 10 Others Wusf Public Media